A good pitch of an idea provokes feedback of the audience. If people are just sitting there, watching politely, smiling, and walking out of the room, you are unlikely to land an investment.

When you get feedback (praise, criticism, difficult questions), it is important to realise who it is coming from. Do people care about you, want to help you? Do you they have the right background?

- Your mother: she totally admires everything you do, but in most cases might not have deep knowledge of what it is you are actually doing

- An industry incumbent who cannot see any change happening having worked in the field for 30 years

- A (potential) competitor who is jealous

- A friendly investor who does not understand the field

- A friendly investor who does understand the field

- An interested investor who is negotiating with you

- A friend of a friend of a friend who is an expert in the field but who was arm twisted in listening to you to return a favour but does not really have time for this and/or you

- Etc.

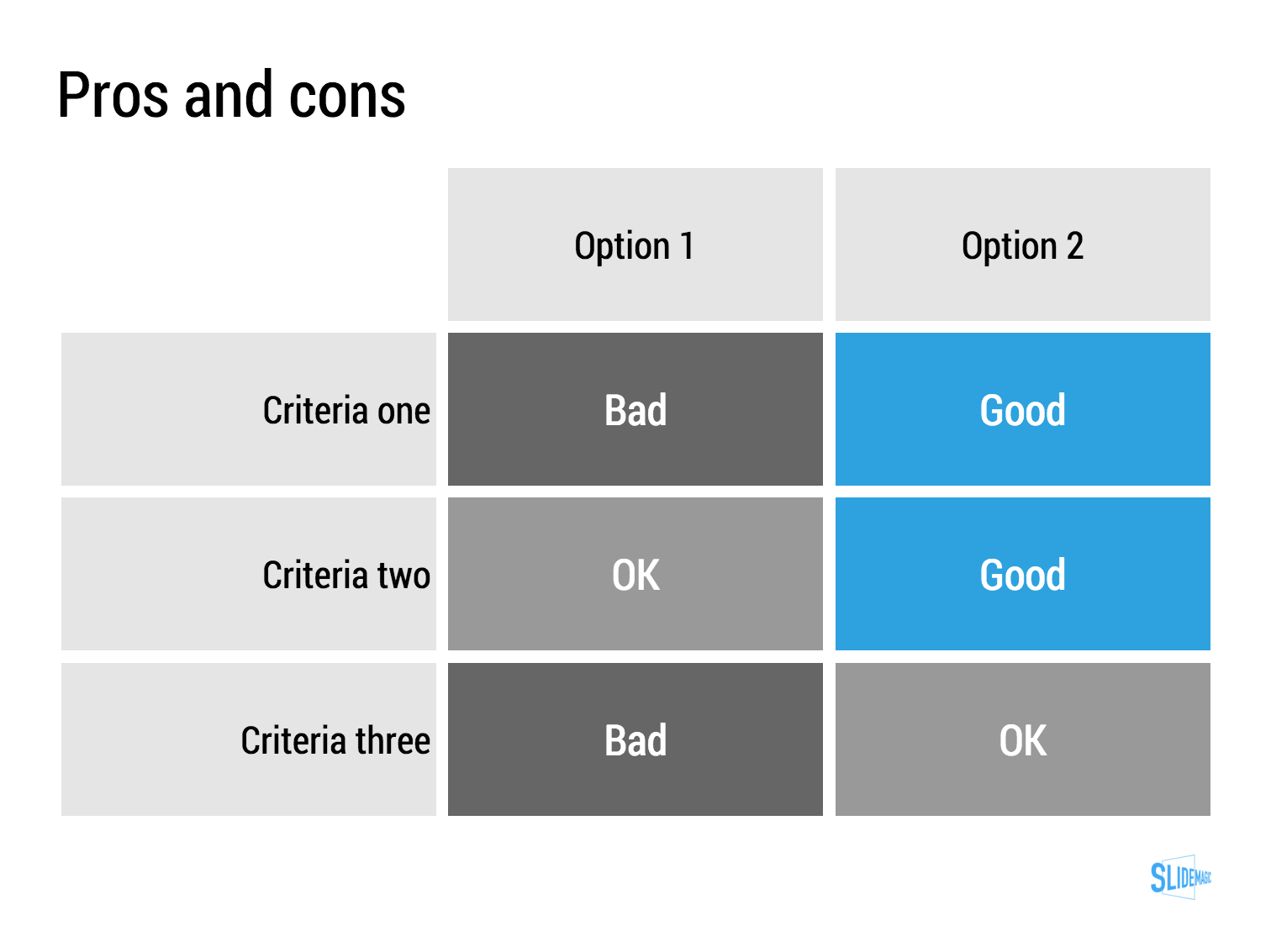

Pay special attention to people who know what they are talking about, or people that are an example of a type of audience you are going to pitch to a lot (confident, successful investors, that might not fully understand the ins and outs of your market). Group one helps you bullet proof the content, group 2 helps you bullet proof the presentation.

What sort of feedback do you get:

- Generic praise

- Generic suggestions to change your presentation (summarise everything early on, re-order these 2 slides, cut the amount of charts to max 10, the 10/20/30 rule)

- An easy question with 3 buzzwords in them

- A difficult question that you know is a difficult question but you don't have the answer to

- A difficult question that you thought you explained well in the presentation

- A difficult question that you heard for the first time

Some feedback can be ignored (the audience is not qualified, the feedback is generic, polite small talk). Some feedback is an "attack" aimed at hurting you (a competitor who feels threatened, an investor who wants to push the valuation down). But most feedback probably is from people who try to be helpful or really don't understand something.

Faced with criticism, humans tend to go in defence mode. We hardly let the questioner finish her question. We don't read body language. We fire away our ammunition. Repeat the same answer, the same slide one more time, forgetting that it failed to convince the audience the first time. Point at a huge Excel model (cell C27) that has 5000 lines of code that proves that you are right. Do what politicians do: divert the attention to another issue.

The most useful feedback might a small unexpected question, from someone who has no reason to help you, is not negotiating with you, has no time for this meeting, and is a huge expert in the field. Read the body language. Ask the person to elaborate on the question. Ask why she thinks it is an issue, what experience does she base it on.

Other good candidates for feedback are potential customers or users. Hold your fire, and listen carefully.

Sometimes it is useful to ask a lot of questions to the people who ask you questions.